A lot has changed in the trucking industry since the record-setting levels of 2018. Freight markets are looser.1 And more changes loom on the horizon. Fortunately, there’s a lot we can learn about recent developments to help you prepare for a successful 2020, including:

- Carrier bankruptcy hitting the trucking industry hard

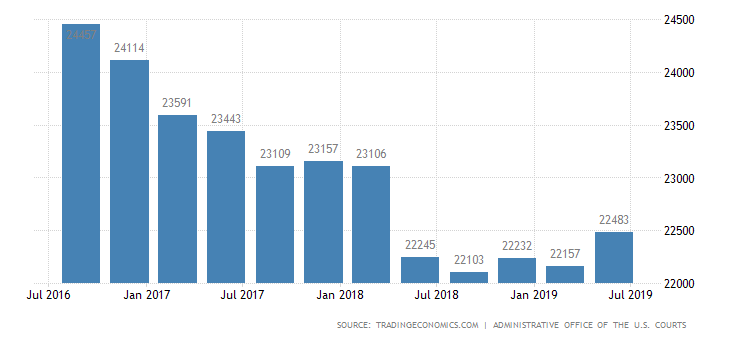

Eight mid-size trucking companies, and many smaller firms, have folded in 2019, leaving at least 3,000 truck drivers unemployed — and adding to the growing number of U.S. business bankruptcies.2 Retailers and manufacturers are simply moving less freight. Plus, truck companies have to spend more just to keep the lights on.

The insurance market is a lot like the trucking industry in at least one way — less capacity drives higher prices. 2019 has seen transportation insurance premiums increase by as much as 20% as insurance companies reacted to last year’s high traffic levels. It’s a trend that’s plagued the industry for years. Rates have doubled, or even tripled, since the beginning of the decade.

We don’t expect insurance rates to curb any time soon. Companies are outfitting advanced technologies on more rigs, including mandated ELD systems, so premiums will rise as the value of trucking assets increase. In addition, liability insurance — and litigation suits and payouts — are putting many companies in financial peril. Expensive umbrella policies are common as companies try to protect themselves.

- Freight Alley Heating Up

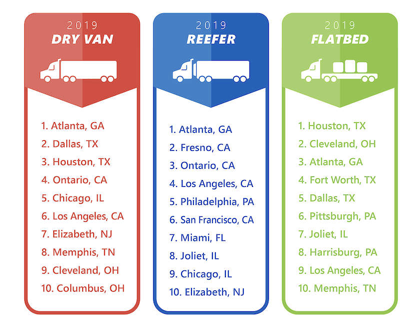

With Atlanta being the number one freight market, and up to 80% of the nation’s truck freight traveling through Chattanooga, “Freight Alley” is a manufacturing, distribution and logistics powerhouse.3

It’s about to become a lot busier.

The Port of Savannah is already the 4th busiest port in North America. A $2B project to double its traffic within a decade is underway. As container traffic increases, trucking companies and 3PL services are getting creative with how they move freight.

The entire supply chain — including shippers, trucking companies, 3PLs and freight technology companies — is relying more on chassis sharing to move more freight to multiple destinations in Freight Alley with fewer delays and for less cost. As most ocean carriers leave the chassis ownership market, trucking companies will continue to expand their own chassis fleets in order to manage capacity constraints from rising cargo volumes and driver shortages. Or, they’ll lease chassis to optimize every haul.

- Technology and transparency

The softer market has created a tougher challenge for trucking and 3PL companies. Shippers are demanding more freight transparency, often as frequently as every few minutes. They want to know precisely where freight is, and when it’s scheduled to arrive.

The issue for many trucking companies, however, is that those same customers are much less interested in unloading the freight quickly. Trucks sit on docks for longer periods, knowing that the market is looser and that there’s an abundance of other trucking companies and carriers who won’t complain because they need the business.

Companies will continue to invest in safety and tracking technologies, because both have become must-have capabilities in an industry where more data and transparency lead to more informed decision-making.

- Partners Matter

There’s no surefire way to predict the future of supply chain. But there is a best way to prepare for it — stick to what you know.

You know the providers who have met your expectations in the past. You know which ones have the strategies, assets and logistics services to meet your needs. You know which ones understand the local and long-haul market. Use it all to your advantage.

Obviously, price matters. But it’s not necessarily the most important thing. The small savings today could lead to big problems tomorrow.4 It’s important to work with providers you’ve vetted and can trust to move freight quickly and consistently throughout 2020 and beyond.

Collins White, President of Logistics, AMX Logistics

1 — https://s29755.pcdn.co/wp-content/uploads/2019/05/DAT-Van-Freight-Rate-Index.png

2 — https://d3fy651gv2fhd3.cloudfront.net/charts/united-states-bankruptcies.png?s=unitedstaban&v=201908031214a1

3 — https://www.dat.com/blog/post/top-10-markets-for-freight-in-first-half-of-2019

4 — https://www.freightwaves.com/news/conditions-for-fleets-are-deteriorating-and-it-will-get-bloody